by H. James Harrington and Thomas McNellis

The infinite monkey theorem, as originally established in Emile Borel's book, Mécanique Statistique et Irréversibilité (J. Phys. 5e série, vol. 3, 1913), presented a genuine probability where monkeys typing randomly could eventually produce all the works found in the French national library (or, in the restatement of the theorem popular with speakers of English, the collected works of William Shakespeare). Time was the most critical factor in this strange theory. The basic premise of the statistical proof indicated that, given enough time, anything was possible. The point was also made that, during the effort to achieve this exceptional deliverable, most of the output would vary significantly from the true goal of creating a remarkable collection of literature. Also, a considerable stream of discordant words and sentences would surface during the random and spontaneous process of "hitting the mark."

The fact that this theorem still remains intuitively sound seems counterproductive to the application of quality as we know it today. Analyzed from a different logical perspective, Borel's assumption of providing the latitude to consistently "get it wrong" allows one to speculate as to how the frequent misuse of any tool (in his case, a typewriter) can eventually result in significant gains.

The same analogy could rationally apply to other tools--for instance, quality metrics. According to our research, companies that based critical business decisions on effective metrics outperformed those that didn't use metrics by a significant margin during a period of five years. The case could be made that "shooting for a target" is the reason why some businesses succeed over the long term while less strategically focused organizations lose their way. Business metrics (or "metric mania" as some might call this weekly exercise of calculating, collecting and distributing business measurements) have been an area of reflection for some time now. How many metrics are too many? Which metrics are the right ones? Who should generate the metrics? What is the best way to distribute metrics? Which metrics should stakeholders receive? Which metrics should be used for decision making? Who should make those decisions? How will those decisions affect customers? Similar questions have challenged quality professionals going all the way back to the time of Walter A. Shewhart. But, as Borel's theorem might suggest, a company could make a number of bad decisions from misdirected metrics and still eventually realize significant advantage. If we accept that fact as true, just think how much success a company could realize if it used the correct metrics for decision-making purposes from the start.

Time constraints are critical in the real world, and there's no room for monkey business. Market deterioration could occur as quickly as competitors generate new product and service ideas. Changes in business strategy can permeate throughout an international organization faster than most people can complete a day's work, and people's livelihoods can be affected during the process of implementing decisions. Thus, good decisions, based on well-directed metrics, are imperative for success. Although the scope of this article doesn't stretch to educating executives on decision-making skills, we do attempt to provide recommendations for correctly using metrics.

Why do so many companies consistently use the wrong metrics to make decisions that affect markets, customers and strategy? A plain and simple fact of business will always be that some measurements won't hit the right mark, some will be used to achieve short-term gains that are detrimental to long-term success and others can't be used for important decision-making purposes. Poor decisions result from using incorrect metrics.

Therefore, we'd like to establish three general rules for mobilizing the right lean metrics for success:

1. Lean metrics are critical for decision-making purposes.

2. Developing a lean enterprise is an essential foundation for good metrics.

3. Categorize measurement areas into an easily understood format.

All three are necessary for breakthrough improvement. If any are missing, business revenue, cycle time and customer satisfaction could be negatively affected. The rules provide a common infrastructure to remove operational roadblocks. If the three rules are applied correctly, business decisions could produce significant gains.

Lean metrics are critical for decision-making purposes.

We've always been champions of metrics because measurement is the first step that leads to control, and, eventually, to improvement. If you can't measure something, you can't understand it. If you can't understand it, you can't control it. If you can't control it, you can't improve it. Although every company requires metrics to remain sharp in a competitive world, the sheer number of metrics has increased dramatically since the introduction of Six Sigma to corporate America.

The rising costs of products and services have placed U.S. companies under pressure to improve efficiencies to stay competitive in a world that depends on reliable products at cheap prices. As a result, many CEOs kicked off Six Sigma programs to drive down costs. The corporate sponsor was usually the CFO, and the charter was to reduce process waste while increasing department efficiencies. However, some of the metrics used to provide business-case justification also ended up being used as decision-making tools. One example is total dollars saved (TDS). TDS has always been a favorite metric that CFOs used to predict the health of company-sponsored Six Sigma programs. TDS might be a good gauge to justify projects, but it has never been a good metric for revitalizing a shrinking market share. Many related metrics have caused unexpected side effects such as pockets of resistance to change, confusion over corporate objectives and questionable business decisions. Although define, measure, analyze, improve and control is a very useful tool to realign business processes with customer expectations and to maintain a solid focus on quality, Six Sigma isn't much more than statistical process control (SPC) and design of experiments (DOE) wrapped into one neat, 3.4 defects-per-million-opportunities benchmark. SPC and DOE were never meant to steer businesses into future markets. Six Sigma's main theme has always been to minimize process variation. Let's take a moment to review why Six Sigma metrics can't be used for leading organizations.

Motorola claimed huge savings from Six Sigma and was also awarded the Baldrige Award for performance excellence. Yet the company's total market share dropped from 60 percent to 15 percent, sector-operating income dropped to 50 percent less than other companies in the same industry that didn't use Six Sigma and the program failed to engage long-term customer loyalty. Although Six Sigma allowed Motorola to produce a higher-quality product at lower cost, it looks like it didn't do an adequate job. Motorola's former CEO, Christopher B. Galvin, explained that Motorola would have been more "agile" and "flexible" by outsourcing manufacturing. Motorola recently changed its Six Sigma approach to a new leadership-focused model because the original, which is still used by many companies today, didn't enable the company to remain globally competitive.

General Electric Co. claimed billions of dollars in Six Sigma savings. However, under Jack Welch, GE made a series of acquisitions, including RCA with its NBC television network. These resulted in GE becoming the world's largest manufacturing, technology and service company, with 1999 revenues of more than $110 billion. The acquisitions provided significant downsizing opportunities that Welch took advantage of immediately. In fact, Welch received the nickname "Neutron Jack" because of the number of employees that were fired or laid off during his tenure. Although he retired in 2001, while he was in charge of GE, Welch made a significant effort to consistently reduce head count. GE also set a goal to outsource 70 percent of its manufacturing, support desk, receivable and information-technology work. Six Sigma metrics didn't help the company remain competitive; rather, it was the "hatchet-man" strategy of its CEO.

General Motors is another example where an incredible amount of Six Sigma savings were claimed. In point of fact, the company recently laid off 30,000 workers, the foreign market remains elusive, unemployment costs have been a significant burden and the company will realize a reduction in total productivity due to its loss of personnel. GM is still attempting to convince consumers that its products are the best buy for the money.

Six Sigma metrics are most applicable in the following areas:

• Improved customer satisfaction

• Reduction in errors

• Realigning processes with customer requirements

Overall, in cases of cycle time and cost reduction, tools such as process redesign and lean management work better than trying to reduce variation. When it comes to key measurements like cost, cycle time and processing time, decreasing variation is far less important than changing the mean.

Developing a lean enterprise is an essential foundation for good metrics.

Each consecutive year of international cooperation brings new opportunities and new challenges. The efforts of U.S. businesses to reduce waste have been ratcheted up a notch or two to compete with low-cost providers around the globe. Much of the past few years has been spent on launching and building corporate strategies that focused on new markets, cheaper products and better services. However, there have been limited efforts--at best--to digest changing customer requirements and growth strategy into the business culture at the process level. This is a big mistake because broken processes result in higher costs, increased head count, bad customer experiences and reduced market share. Also, under this state of cultural panic and confusion, bad business decisions are usually made. That's why it's necessary for businesses to take a moment to look internally and develop a lean enterprise. In a lean enterprise, each department removes nonvalue-added effort, eliminates duplicated steps, aligns customer requirements with process value, reduces costs and focuses on premier critical-to-quality (CTQ) characteristics for customers. A lean enterprise forces the executive team to make the conscious decision of which strategies to champion and provides process improvement teams with 100-percent buy-in, vs. process leaders having to sell each effort.

A plan is no better than the commitment of its creators. Plans establish a direction at a moment in time. In a lean enterprise, champion training is held every quarter a business plan deliverable is updated and then treated as a living document. As market and customer conditions change, the executive team makes adjustments to the corporate vision, charter and goals. As the year brings new insight and better focus into areas that are just beginning to brim on the horizon of competition, the company can make the appropriate adjustments. It's this business plan that sponsors use to create departmental vision, charters and deliverables as the market conditions around them change.

Following is a case study showing how lean enterprise has been implemented into a particular hospital's environment. This hospital's goals for fiscal year 2006 were ambitious and required each of the department heads to focus on cutting costs while increasing services. Despite the plethora of changes within the hospital environment mandated by the Food and Drug Administration during the last two decades (by creating coherency in clinical outcomes and effectiveness), little was being done to drive large-scale hospital efficiencies. During the later part of fiscal year 2005, a lean enterprise initiative was launched throughout the spectrum of operations. At the heart of this effort was the creation of key drivers of superior performance. Although, in the past, "successful performance" was defined by revenue and income, the state of current competition compelled the hospital to consider both clinical and managerial effectiveness from a customer-satisfaction viewpoint.

The model derived in this business plan had six goals, each of which represented a separate advantage in its own right. Although some phases could be carried out simultaneously, when all efforts were combined, the economies of scale would provide an incredible amount of operational savings, and boost revenues and employee empowerment.

The details of hospital goals for fiscal year 2006 are:

• Improve customer satisfaction

• Redesign service processes to enhance patient outcome

• Develop strategies to improve physician satisfaction

• Create programs that serve unmet client needs

• Measure and improve processes

• Create employee awareness of health care economics

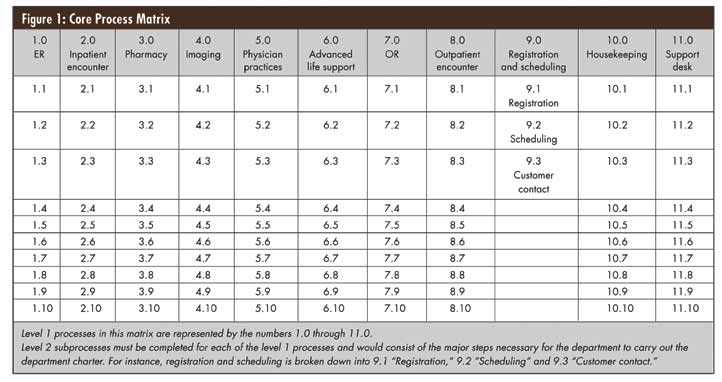

The hospital has 11 core business processes. Core processes create direct value for the product or service that customers consider to be valuable. Each department goes through a lean-line effort to realign process steps with customer CTQs. The registration and scheduling core process is used as an example in figure 1 below.

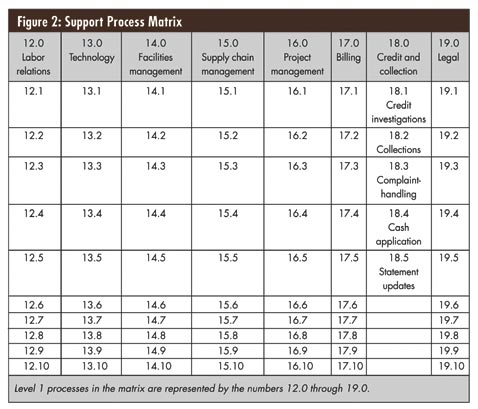

The hospital has eight support business processes, as listed in figure 2. A support process better enables core processes to create value to customers; support processes don't contribute directly to the primary product or service.

Figure 3 below provides a visual example of how the level 3 business process for 9.1.1 "Registration" is further subdivided into microprocess steps and diagrams. In this example, process inputs and outputs are analyzed to determine if end-to-end flow is as it should be. The breakdown of business processes into this level of detail enables department personnel to determine whether the steps create value for the customer, are duplicated, or are inefficient and ineffective. This basis of understanding provides a comprehensive overview for department staff and outside-department personnel. Creating customer value is now visual.

Categorize measurement areas into an easily understood format.

Metrics must be generated at the department level by management and sent all the way down to the employee level.

In some companies there are too many metrics (and most of them aren't the right ones). With other companies the metrics go to the wrong people, or the actions taken are inadequate or just plain wrong. In a sense, numerous companies are collecting "monkey metrics" while on their way to collecting meaningful information.

To better compete today, more domains of influence are necessary. A business metric report card such as the one shown in figure 4 below should be owned by either the CFO or COO, and all stakeholders should have access to this information.

Executives indicate that understanding how their products and services compare against similar products and/or services enabled them to make better decisions on how to provide a one-stop shopping experience for customers. Adherence to vision and strategy enables everyone in the company to create one vision to strive toward. Lean partnerships enable companies to increase market opportunity without expending a large amount of capital.

Six Sigma initiatives focus on dollars saved. Certainly that's a good financial metric, but it's one of the poorest measures of quality. If dollars saved is the primary way to report Six Sigma, then it's not customer-focused and should be headed by the CFO rather than the quality department. From our standpoint, the primary quality measurements in order of importance are:

• Customer satisfaction

• Repeat sales

• Market share

• Mean time-to-failure

• Poor-quality cost

• Early-life failure rates

• Warranty cost

• Percentage of returned items

• First-time and throughput yields

• Suggestions per employee

• Dollars saved

If Six Sigma's purpose is to improve customer satisfaction, it's just plain wrong to measure success by dollars saved. The best measure of better quality is growing market share. Six Sigma shouldn't be a cost-reduction program.

H. James Harrington is CEO of the Harrington Institute Inc. and chairman of the board of Harrington Group. He has more than 55 years of experience as a quality professional and is the author of 22 books. Visit his Web site at www.harrington-institute.com.

Thomas McNellis is a researcher and international scholar in the fields of Six Sigma, project management and operations management. He currently teaches Six Sigma and information technology at the Drexel University of Technology in Philadelphia. He also serves as dean of education and certification for Harrington Institute Inc. and is the president of the Association for Quality Research, a nonprofit organization that focuses on cutting-edge business research and corporate best practices.

|